How many stocks should you own in your portfolio? Souce: Stockopedia (www.stockopedia.com)

How many stocks should you own in your portfolio?

Souce: Stockopedia (www.stockopedia.com)

Individual share prices are astoundingly volatile. A useful practical measure of volatility is the difference between the high and low of a share's price over a twelve month period. Since September 2013 the average share on the London Stock Exchange has a high price more than double its low - yes more than double, 112% to be precise. When you consider the FTSE 350 index itself has only had a 14% range over the same period it's a massive difference.

Given this natural volatility, there's a serious risk to your wealth if you only bother to own a solitary stock. Most people take steps to sensibly diversify in order to reduce the chance of serious capital loss. But studies of brokerages show that the average investor only owns around 4 stocks in their portfolio. This extreme concentration suggests that many investors are either shooting for the moon or very poorly informed on the subject of diversification. So lets dive deep...

Just a few stocks...

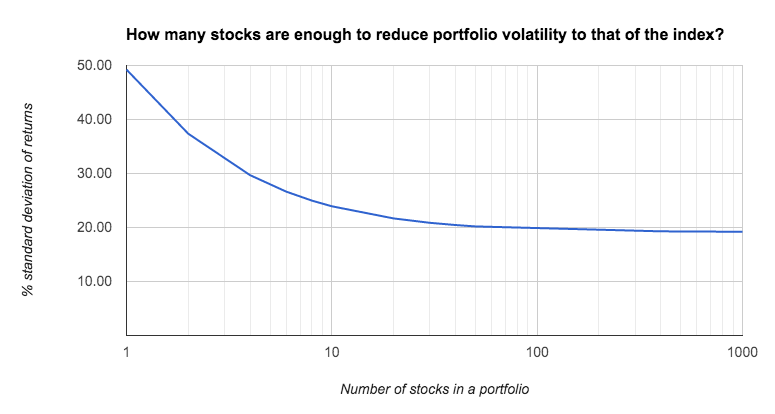

A famous study by Elton and Gruber in 1977 may have started the trend for heavy concentration in portfolios. It's conclusion was startlingly provocative, showing that most of the gains to be had from diversification come from adding just the very first few stocks to a portfolio.

According to these results adding just 4 more stocks to a 1 stock portfolio gives you 71% of the benefits of diversification (in terms of volatility reduction) of owning the whole market, with the benefits tailing off as you add more and more. The chart below using their data clearly illustrates this point.

These results were confirmed in a whole ream of follow up studies by other researchers in the 1980s and 1990s, the general consensus being that the purchase of anywhere between 8 and 20 stocks is 'enough'. But before everyone gets carried away and goes super-concentrated in their portfolios - lets step back and think about this a bit more.

The wrong kind of risk...

In 1996 Gary Newbould and Percy Poon, a pair of finance professors at the University of Nevada, published an article in the Journal of Investing which seriously challenged these results. The previous research had focused on how many stocks were needed to reduce volatility, but completely ignored the risk that the resulting portfolio would fail to show adequate performance.

"Individual investors face an enormous range of portfolio risk if they follow the standard recommendations. At the 8 to 20 stock portfolio sizes recommended, average performance is very volatile. At the 8 stock portfolio size with small stocks, investors would tend to fall in the range of [between] 159% to 41% of the average [index] return."

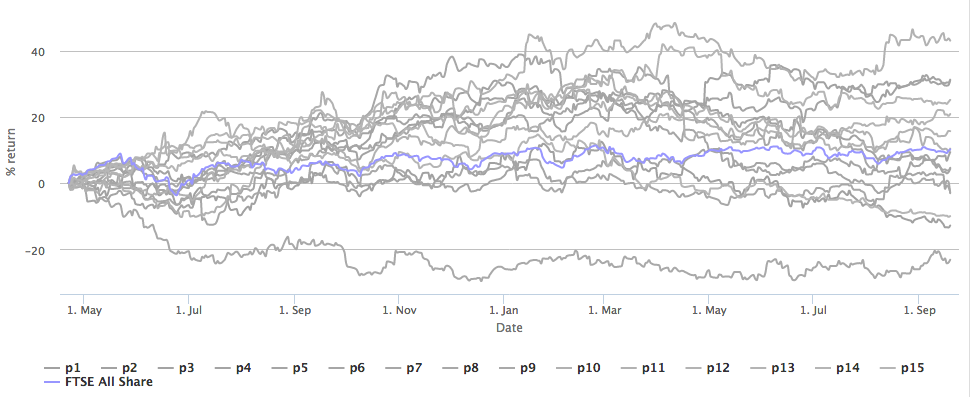

Imagine a set of monkeys throwing darts at the stock market to select 8 stocks for their portfolios. While I'm sure they'd have some fun, the set of outcomes would clearly be wildly divergent - a fact not taken into account by previous studies. A return of only 41% of the average index performance wouldn't be great for the monkey who's losing out. Here's an illustration of the divergence of returns using completely random 8 stock portfolios in the UK generated using the Stockopedia engine:

The comfort zone...

To counter this, Newbould and Poon suggested that rather than select a specific number of stocks, investors should select a probability of success they are comfortable with and then figure out how many stocks are required to achieve it.

"Our examination of risks and returns seem to support new recommendations. It is clear that the minimum portfolio size markedly exceeds the long accepted recommendations.

A useful rule of thumb from their study is that if you are comfortable being within 20% of the average return and risk then you'd need a minimum of 25 stocks in your portfolio. But if you want to be even closer to the averages, you'd need a lot more - even up to 100.

Synthesising portfolios at Stockopedia

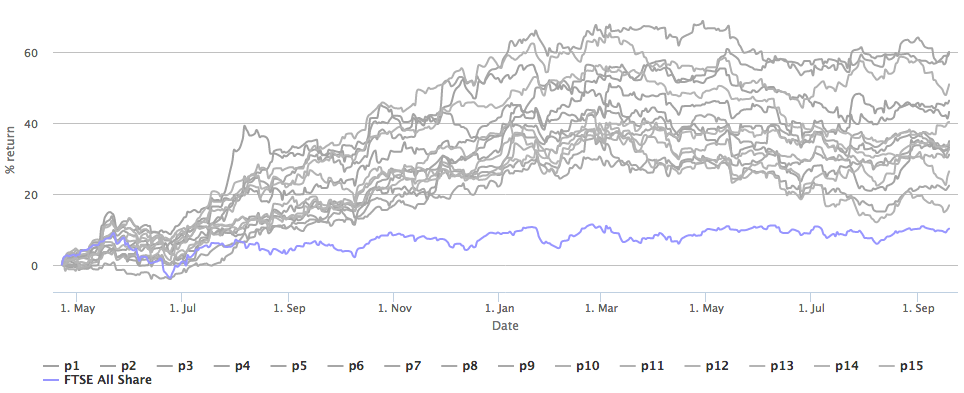

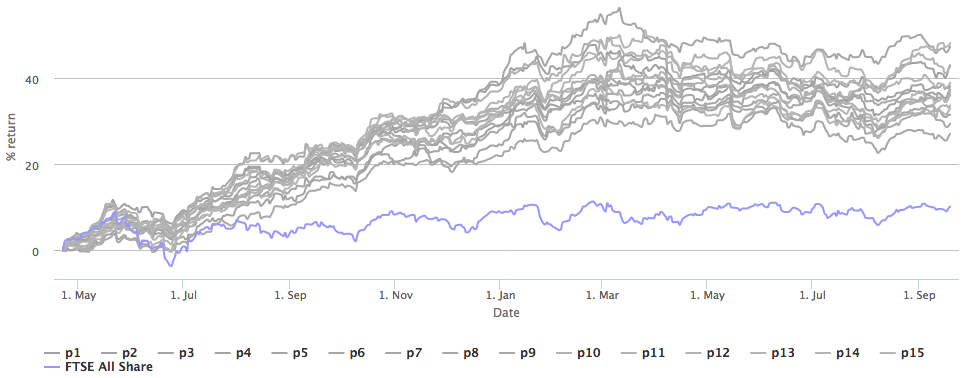

Of course owning too many stocks becomes impractical (and often too expensive) for most individual investors so the 25 stock starting point is a very useful one - recommended by James O'Shaughnessy in his excellent "What Works on Wall St". The findings of Newbould and Poon are also much more in tune with what we've found generating random portfolios using the Stockopedia StockRanks. In the following pair of tests we've created random portfolios of £10m+ sized stocks with a StockRank > 90. The first portfolios have only 8 stocks in them, the second have 25 - the difference in variability of outcomes is startling.

The clear point visually made is that if you want to run a systematic portfolio in the stock market and harvest the payoffs available, it's prudent to diversify more widely than you might have previously thought. It maximises your chance of a generating a satisfactory outcome if you invest in a minimum of 25 stocks and lowers many risks - especially the risk that you might actually not be as good at stock picking as you think you are.

“Choosing individual stocks without any idea of what you're looking for is like running through a dynamite factory with a burning match. You may live, but you're still an idiot.” Joel Greenblatt

Closing thoughts

Yes, we all know some investors who have got rich with hugely concentrated portfolios, but can you really be sure they aren't just the coin flippers who got lucky? Do they ever stop to consider the number of investors who try to do the same and fail dismally? The more our research capacities grow at Stockopedia, the more the evidence convinces that it may be more prudent trying to synthesise the perfect stock through a broadly diversified portfolio than trying to pick it.

A caveat. One of the critical things I haven't covered in this article is the consideration of costs. Owning more stocks is expensive in small portfolios. While we can muse that it's ideal to own 25+ stocks, if your portfolio is only worth £10,000 it will be prohibitively expensive to trade so many. It's out of the scope of this article to go into this in depth - but if you are interested to know where the balance point is for your own portfolio check out this article on the subject.

Hey, thanks for the information. your post s are informative and useful.

ReplyDeleteLongview Tea Company Ltd